Spring Runoff Season

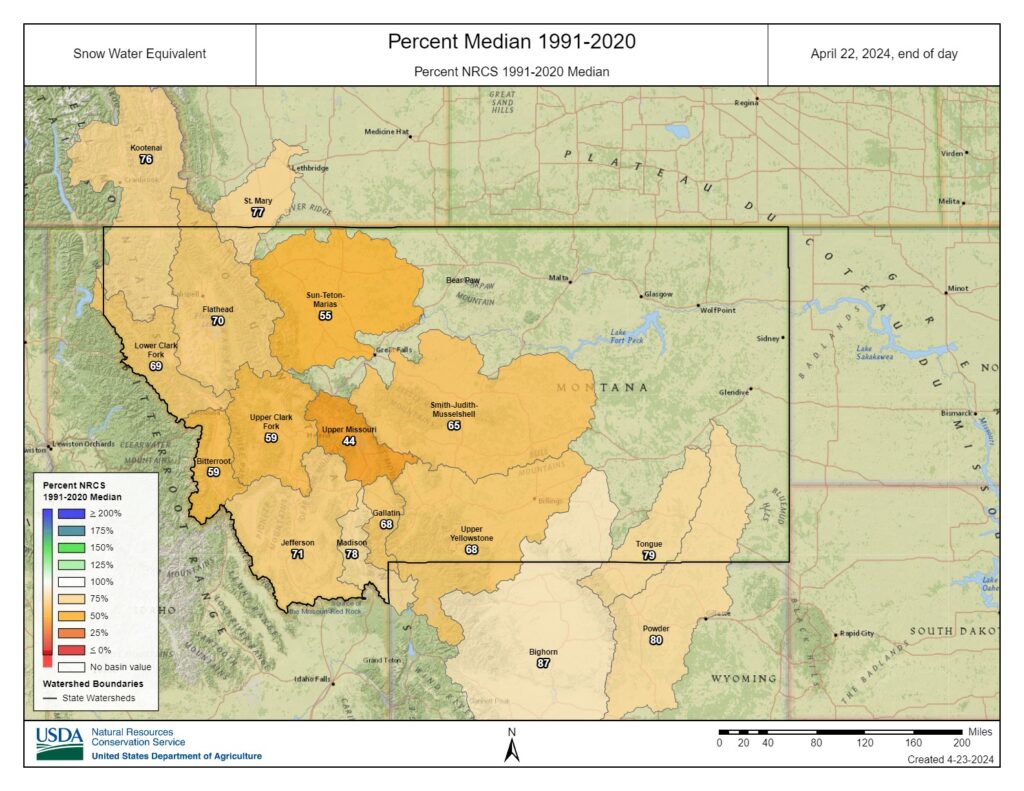

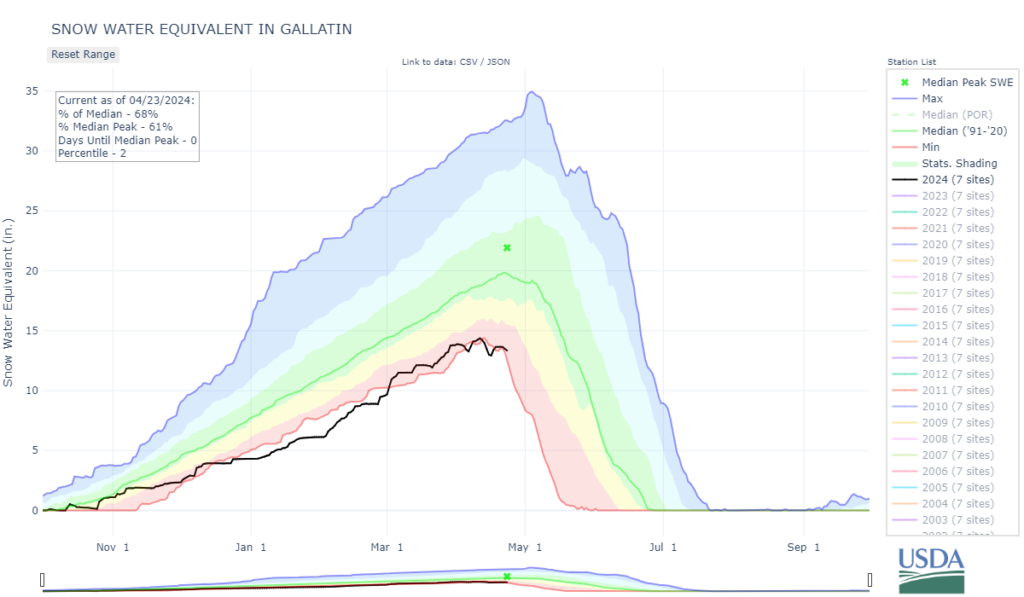

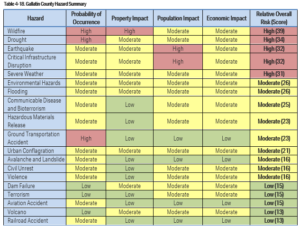

May and June in Gallatin County are the months that we frequently see our peak runoff due to snowmelt and precipitation events. While we don’t have a large amount of snow in the mountains, and the valley floor is clear, the possibility of flooding still exists. We are unlikely to see a large widespread flood event, we could very well see isolated issued caused by significant rain events during warm weather that cause a quick release of the mountain snowpack.

The best defense from flooding is to help keep the water where we want it. This is a great time of the year to make sure ditches and culverts are clear of debris. It is common to see isolated flooding caused by some sort of blockage. If your property is prone to flooding, we encourage you to annually develop a plan of what you will do to protect your property in the event a flood incident occurs. Once flooding occurs, the damage is typically done. If you ever think your property will be affected by flooding, act before it directly affects you.

Additional resources on flooding are available at: https://www.readygallatin.com/community-resources/preparedness-information/flooding-in-gallatin-county/